A Global monetary reset- A myth or a reality!

Taking the present global geo-economic uncertainty and speculations head-on

Gresham's law is a principle that states that "bad money drives out good" - Sir Thomas Gresham, Founder of the Royal Exchange (1565), City of London

This is a short opinion piece by Aneesh M Nambiar. I am an avid follower of macro, geo-economic trends and a student of economic history. I analyse patterns across disparate global events, all of which tell a story as pieces of a puzzle and provide causation for many events we see around us as well as insights into how things may pan out in the future.

Earlier in the second half of 2024, I had published 3 articles in my Substack on the burgeoning debt crisis globally that was created by the uber consumerism and financialisation of the world, followed by an article on why sound money (gold) is a protection against an impending monetary reset along with its drivers as well as potential global triggers and a third article on demystifying the EU AI law and its implications to putting check on the expansionism of the big tech in our lives. While each of these articles seems disjointed as they are on three diverse topics, the underlying theme has a convergence that we are about to see very soon unfold over the next many months. In this short article, the focus is on the historic perspective linked with the various actions being considered by the US to enable this reset. It doesn’t fully delve into the process how this reset shall take place and the end game post reset. It also consciously stays clear of the geo-political aspects while focussing on the visible economic pieces of this puzzle.

There is also a reason for timing this opinion piece now, after the US election and the subsequent first 100 days of the new US administration by President Donald J Trump. The ever growing global debt situation enabled by a US led global monetary system is in its last lap of sustenance as we meander through the rest of this decade. The leaders of the new US administration are vociferous about an impending new Bretton Woods (1944, New Hampshire) type monetary reset and creation of a new multi polar equitable world order. This includes the Treasury Secretary, Scott Bessent who is known for his prowess in dealing with the currency markets right from his early career days in 1992, where he was a leading member of the firm whose Black Wednesday bet collapsed the British Pound sterling.

While there are different approaches to how this may take shape over the course of next several months, the notable ones led by the present US dispensation are the following:

A) Peter Navarro’s (American Economist, Senior counselor for trade and manufacturing, US) trade tariff plan. It has to be noted that tariffs, while aimed to bring down trade deficit are known to create higher inflation, market turmoil and in turn lead to decoupling trade partners if not managed properly especially the China-US trade. Given US’ over reliance on China over essential goods, and its aspiration to start manufacturing at home; it remains to be seen how they will manage a tight rope balance between competing priorities of dollar devaluation, labour readiness for manufacturing, interim management of inward supply chains while keeping inflation at bay.

B) Scott Bessent’s (Treasury Secretary, US) 3-3-3 plan. This involves reducing the federal budget deficit down to 3 percent of gross domestic product (GDP), getting real GDP growth to 3 percent, and producing an additional 3 million barrels of oil a day by 2028

C) Stephen Miran’s (Chair of the Economic Advisors, US) Mar-a-Lago Accord. While named after Trump’s Florida estate, the Mar-a-Lago Accord is the name given to a complicated set of plans and concepts from Trump’s economic advisors that would mark an inflection point for the global economic order including a plan to weaken the US Dollar. This seems to be very similar to the Plaza Accord, an agreement signed at the Plaza Hotel in New York on September 22, 1985, aimed to lower the value of the U.S. dollar against the currencies of major trading partners like Japan, Germany, and the United Kingdom. The accord was then initiated by the G5 (France, Germany, Japan, the United Kingdom, and the United States) to address large trade imbalances and a perceived overvaluation of the dollar. The agreement involved coordinated intervention in the foreign exchange market by the G5 countries, leading to a significant depreciation of the dollar and a corresponding appreciation of other currencies.

While the above 3 approaches (irrespective of their pros and cons) laid down by the respective accomplished leaders of the US administration shall dominate the global discourse over the next several months reshaping global economics, it has to be noted that the Triffin dilemma (often referred to as the Triffin paradox), identified by Robert Triffin in the 1960s, that describes the inherent conflict of interest faced by countries whose currencies serve as global reserve currencies, is a natural consequence. It explains the conflicts faced by hegemonic powers like in our present day US, whose currency when acting as a global reserve, must run trade deficits to provide the world with the necessary liquidity, but these deficits can erode confidence in the reserve currency's long-term value.

It also needs to be noted that President Trump has signed an Executive Order 14196 (A plan for establishing a United States Sovereign Wealth Fund), which normally is seen as offered by countries with trade surplus and not by countries in deficit like in the case of the present day US.

On careful consideration of how these dichotomies are simultaneously possible, one of the methods is a potential gold revaluation of the US Dollar thereby devaluing the US Dollar by monetising the assets side of the US balance sheet as mentioned by Treasury Secretary Scott Bessent in one of his initial comments after taking up the role.

The valuation of US gold holdings has been pegged at $42.22 an ounce since 1973, two years after then President Richard Nixon took the dollar off the gold standard and it continues till date. If the US were to mark-to-market its gold reserves (of ~ 261 million troy ounces or ~8133 metric tonnes) at current market price of ~$3300, they would be worth nearly $900 billion vis-a-vis around $11 billion currently. There are several other methods and formulae for higher value for gold revaluation including as proposed by several economists and market analysts including Jim Rickards, late Jim Sinclair, ranging from $27,000 to $50,000 per troy ounce that could be considered. While strictly not a monetary asset, it also needs to be seen how silver which is one of the most downward manipulated precious metals over the past 5 decades shall behave as it catches up to its earthly mining ratio of 1:7 with gold, rather than its present artificially suppressed ratio that recently crossed 1:100. A revaluation could bring back the glory of the ‘sound money’ as both gold and silver were historically referred to as, prior to its fiat currency representations.

Another way to look at these events taking place today is to compare it with the sequence of events from 1929-1933 that they appear very similar to. The "Roaring Twenties" had been a time of industrial expansion in the U.S., and much of the profit had been invested in speculation, including in stocks. Many members of the public, disappointed by the low interest rates offered on their bank deposits, committed their relatively small sums to stockbrokers. The economic splurge of the so-called roaring twenties, resulted in the market collapse on Oct 29, 1929 (the infamous Black Tuesday) which created an indelible mark in the global economic landscape. This subsequently led to the Smoot-Hawley Tariff Act, signed into law in 1930, which was a U.S. protectionist trade measure that significantly increased import duties. Its primary goal was to protect American businesses and farmers from foreign competition, but it ultimately exacerbated the Great Depression and led to a global trade war. During this period of Great Depression from 1929 to 1933, a significant number of banks (estimated to be 9000 banks) failed, primarily due to widespread bank runs, where depositors withdrew their money en masse. This led to a contraction of the money supply, impacting lending and ultimately contributing to the severity of the depression.

Compare the roaring twenties with the situation in the US presently. Despite President Trump repeatedly calling out US economy as bankrupt during campaign period and now taking drastic measures to secure it, the market seems ever buoyant. Isn’t this indicative of a highly delusional and speculative market which has long forgone its fundamentals and market realism that even when the President calls the nation bankrupt, and takes drastic steps to curb spending, its citizens are unable to realise it as real. The market exuberance created by the cheap money that we witnessed over the past decade exacerbated by the high liquidity provided by post-COVID government payouts, coupled with the low-interest rate environment over the past several years has created a speculative investment climate across both equity markets and potentially also led to the emergence of the crypto markets devoid of any fundamentals. The only difference this time is that it appears that the enforcement of tariffs as proposed by the present US administration seems pre-crisis than the post-crisis that was imposed during the great depression period.

Another way of looking at this is to ask if tariffs are a way to negotiate dollar devaluation with global nations. Will other nations especially from the BRICS and the global south agree this time around? If so, the terms of those negotiations would need to be carefully observed.

The impact of this in the global equity, debt markets and its bearing on the banking system as a whole need to be watched carefully as history indicates greater consolidation and faster wealth transfers during times of crisis. With a debt crisis inducing a liquidity crisis thereby leading to a global monetary reset, some questions remain to be answered such as:

Will this trigger another avalanche of bank bail-ins and if yes how bad will that wealth transfer be?

How will this impact the jobs market when global supply chains are severed and imminently disrupted?

Which sectors will survive and which will thrive during and after the global monetary reset?

Will the reset be a movement towards a new monetary system of CBDCs globally many of which are ready and in pilot phase?

What would this mean to other Western currencies’ valuation that are presently sustained by US Dollar swap lines?

Will this begin the end of the Eurodollar market?

Is US Dollar devaluation and a global monetary reset the real reason behind unleashing of the AI workforce across services sectors as affordability of offshore service placement contracts could come under risk?

Are border crossings and cheap labour movement across several Western countries over the last few years a well-planned manouever to shore-up unskilled cheap labour to restart manufacturing?

What would happen to net importing nations when their currencies devalue and goods for day-to-day consumption will take time for home grown manufacturing?

Will the reversal of the fiat dollarisation era lead to return of the core industries of the yester years (like agriculture, manufacturing, mining, supply chain logistics)?

Is an impending food insecurity a reason why the uber rich is amassing agricultural land in the Western nations?

Would Western currency devaluation bring in more protectionist measures and capital controls in large economies as relative asset valuations in fiat currencies plunge to new lows?

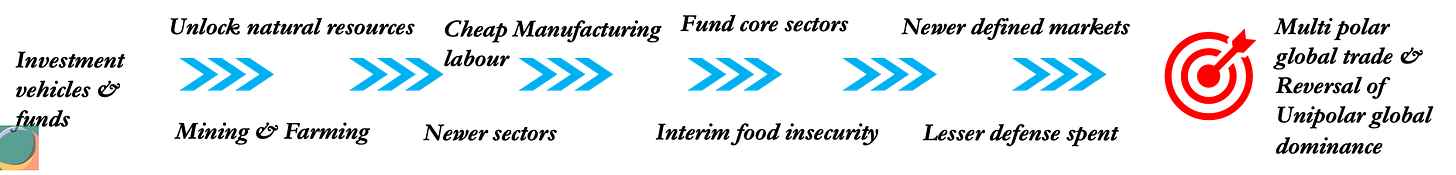

Correlating my prior articles on unsustainable debt, gold accumulation and its Tier 1 categorisation by the Bank of International Settlement (BIS), the emergence of AI in reshaping global services workforce and given these global uncertainties, one of the few things that remains clear is that ‘it is no longer a myth’. There is a big global monetary reset in the horizon and it has several ever lasting global implications both in the West and the Global South emerging nations. This may also aid and abet the following at a rapid pace:

There may be an imminent gold revaluation in cards. Whether the negotiated formula for it is linked to the asset side revaluation marked against the treasury debt or the liabilities side revaluation linked to the money supply (M1, M2) needs to be seen

There may be a decoupling with China and US disrupting global supply chains and also creating newer manufacturing destinations

There may be a USD devaluation against several global currency pairs which will be negotiated in the coming weeks thereby creating a more balanced production-consumption global trade ecosystem once the reset completes

There may be reversal of several services sectors that were created by dollarisation since the 1970s that will eliminate several jobs globally, yet resurrecting industries of the past; thereby creating newer opportunities albeit after a period of sustained chaos

As some of these answers unfold in the coming weeks and months, it needs to be seen how the global chaos that these tectonic geo-economic shifts create, will be managed. It also warrants a careful observation of the foreseen and unforeseen fallouts of such a multi-dimensional global economic experiment. As this planned collapse to reset the monetary system plays out, we will cover in future articles, the shape and form of the end game, its implications, along with the game plan for complete control.